Call Us Today! 1 888-515-8262 (Toll Free)

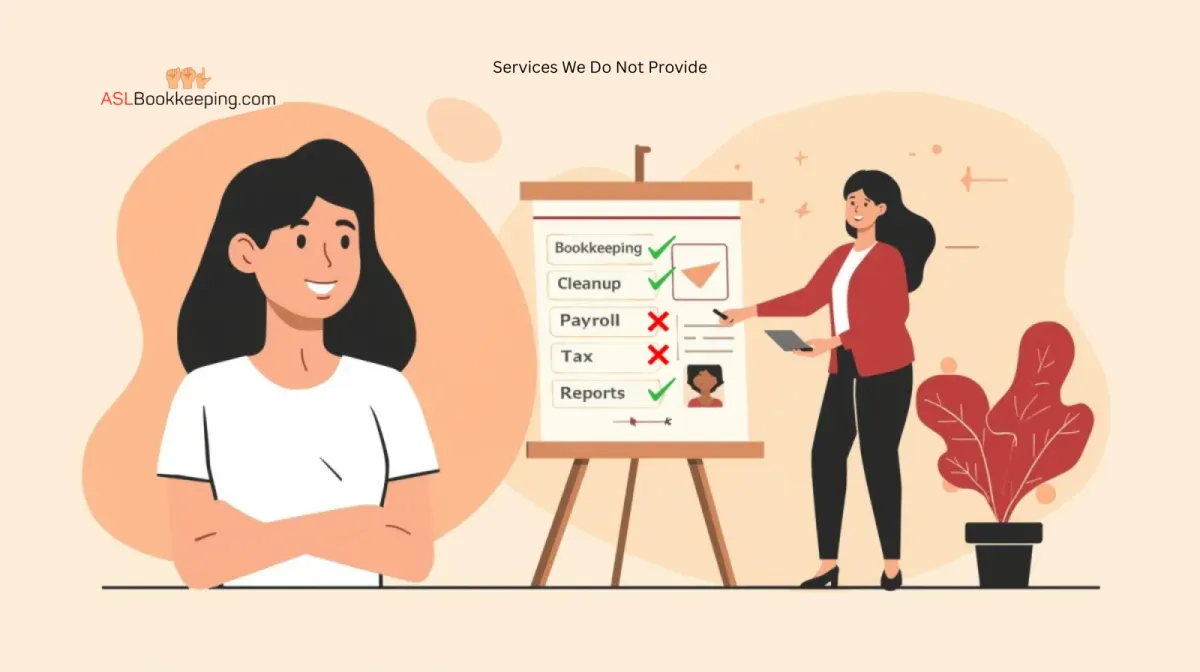

Servies We Do Not Provide

Services Outside Our Scope and How We Coordinate With Your Tax & Payroll Providers

IRS Representation / Audit Defense

Our job is to keep your books clean, accurate, and audit-ready. However, we do not act as Power of Attorney and cannot represent you in IRS audits, appeals, or tax court matters. If an issue ever comes up, we make sure your books are complete and organized, and we will fully coordinate with your CPA or tax attorney to support the process.

Formal Tax Strategy or Advisory

We maintain accurate books and tax-ready financials, but we do not provide advanced tax strategy. That includes entity selection, long-term tax planning, deductions planning, and tax-saving design. For that, your CPA or tax advisor is the best resource. We’re always happy to work directly with them to ensure they have clean, reliable data for their recommendations.

Certified Financial Audits

We provide professional, executive-ready financial reports, but these are not CPA-certified financial audits. If your lender, investor, or agency requires a formal audit, we’ll ensure your records are fully updated, organized, and audit-ready to make the CPA’s job smooth and efficient.

Tax Return Preparation (Business or Personal)

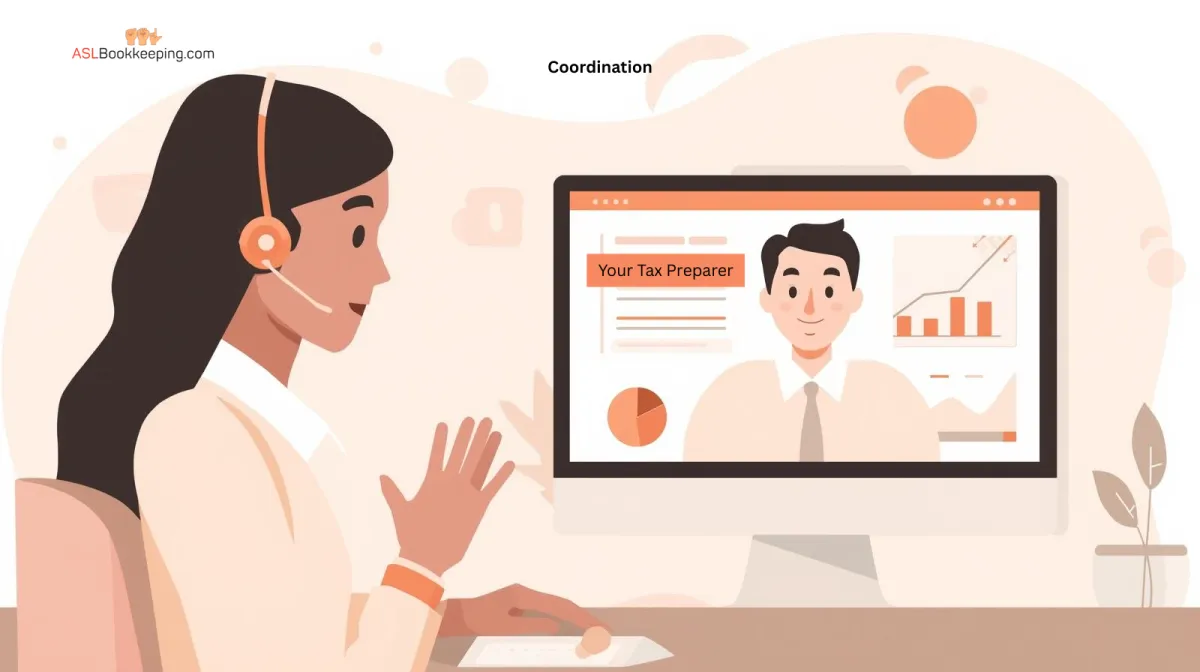

We no longer prepare federal or state tax returns of any kind. Instead, we work closely with your tax preparer or CPA by delivering clean, accurate books, year-end reports, and full documentation so your return can be completed quickly and correctly.

Free Tools To Grow Your Interpreting Practice

Free Marketing Toolkit

Multi-Source Inbox

Forms and Survey Builder

Website and Funnel Builder

Blog Builder

Calendar & Scheduling Builder

Social Media Poster & Scheduler

Mass Email Mailer & Scheduler

Smart Chat - Website to SMS

Reputation Management

Contact Information/Database

Sell Course and Video Membership

Prospects to Clients - Pipeline

Visit us on Linkedin:

U.S.-based bookkeeping built for ASL Interpreters. Certified QuickBooks experts keeping your books clean and your tax preparer supported.

Ways to Contact Us:

1 888-515-8262

Mon-Fri 9am-5pm Pacific Standard Time

© Copyright 2020-2025. ASLBookeeping.com

Fully Owned And Operated By

Digital Ad Cast LLC.

All rights reserved